It’s Friday –payday– and you finish the workday, grasping your paycheck so tight that your knuckles turn white. Tonight, you plan to reward yourself for a tough week by going out and seeing a movie. But there’s a problem.

You’re broke.

When you deposit your check, you forget that it takes at least two days to clear. Add in Sunday and you likely won’t see that money until Monday. So long weekend! It’s like you barely knew thee.

Direct deposit is the solution

Direct deposit allows you to send and receive electronic payments so that you can get your wages without a physical paycheck, and many times, you can get your paycheck earlier. By taking the simple step to use direct deposit, you’ll never find yourself worrying about whether your check clears before a bill was paid or whether you accidentally left your check in your pants’ pocket come laundry day. Plus, with direct deposit, you’ll never have to visit a branch, or even leave your house (although we would love to see you!).

In addition to having immediate access to your funds on payday, you can also designate a percentage of your check to be sent directly to your savings account. This method makes it easier to save money over time because you won’t notice that you had the money in the first place. After all, you can’t spend what you don’t think you have.

How to go direct

The process to register for direct deposit is so simple that there’s no excuse to get signed up. Both employers and banks make it easy because it benefits everyone. You get your money earlier, they save money by reducing paper costs, while the trees are left alone.

First off, ask your employer if they have their own documentation to register for direct deposit. Most companies have their own process for getting you on board. Or try Vantage West’s MoveMyDeposit feature where you can make the switch right from your online banking or mobile app. MoveMyDeposit seamlessly connects with over 2 million employers. Learn more here.

Alternatively, you can follow a less automated process for direct deposit.

You’ll need two pieces of information:

1. Routing Number

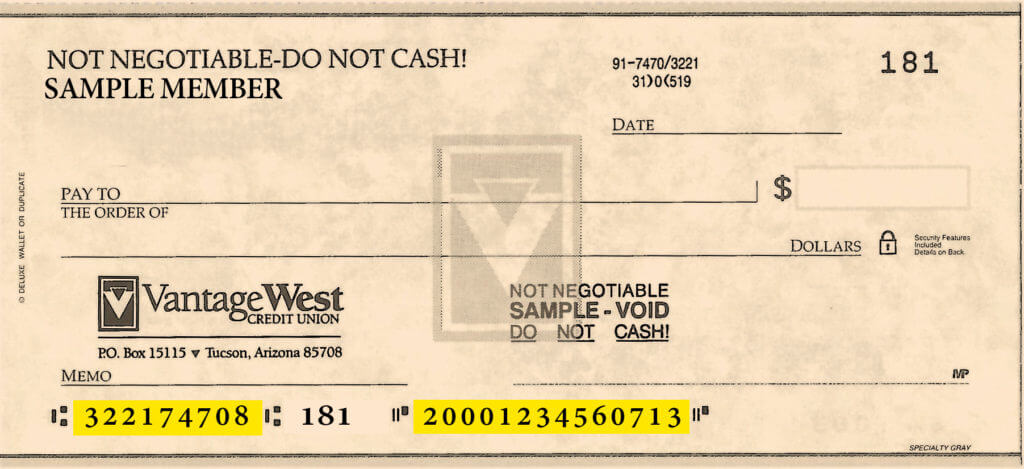

A routing number is the way that the Federal Reserve identifies different financial institutions, but you don’t necessarily need to know that. For your purposes, just remember that the routing number is the 9-digit number located at the lower left-hand corner of your checks:

⇧ – Routing Number

2. ACH Number

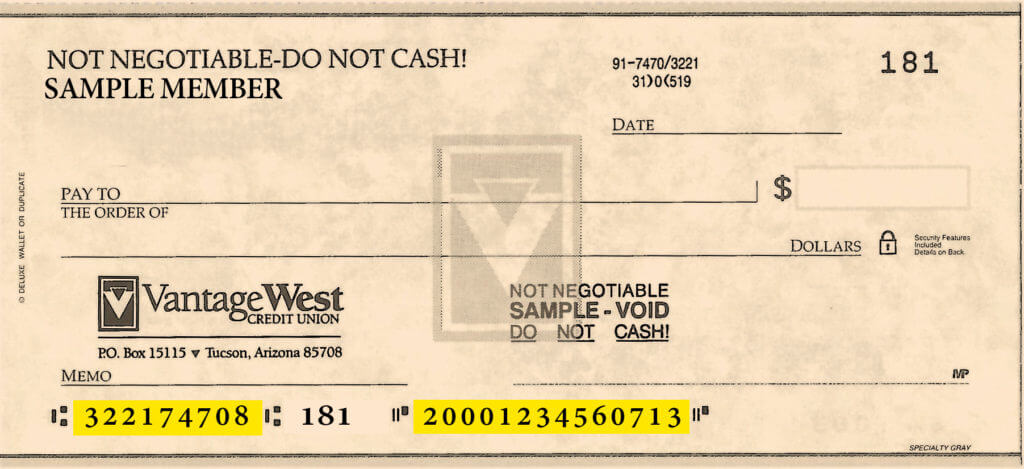

The Automated Clearing House, or ACH number, allows you to send payments electronically through your account. Normally, your ACH account number is the same as your checking account number. But to be sure, your ACH account number will always be the 14-digit number located at the bottom center of your checks:

⇧ – ACH Account Number

Besides these two numbers, you’ll usually need to provide the address of your financial institution and a voided check. For the voided check, simply grab the next available check and write “void” across the front. Like magic, your check is now worthless which, at least in this case, is what you want.

Consider yourself direct deposited

That’s it. Easy, right? It usually takes a week or so to process, and then you should be seeing that paycheck show up in your account balance (which means it’s not really a paycheck anymore, but that’s another issue). Now that you get instant payments, you can enjoy your weekend with no fear.

Set up Direct Deposit or Wire money to your Vantage West Account

Vantage West Rewards Checking: Earn reward points for all qualifying purchases and redeem for cash back. GET REWARDED!