Vantage West Signature Rewards Visa

Earn $200 cash back1 when you spend $2,000 in the first 3 months. Always 2% cashback on dining, entertainment and groceries.2 1.5% on everything else!

Vantage West Platinum Visa

Take control of your finances with 0% APR on purchases and balance transfers for first 12 months3then as low as 9.99% APR. Plus no annual fee!

Disclosures

1To qualify and receive the $200.00 Welcome Bonus you must open a Vantage West Signature® Rewards VISA® Credit Card and make qualifying purchases, totaling $2,000 or more posted to your account, within the first 90 days of account opening. (“Purchases” do not include balance transfers, cash advances, interest, unauthorized or fraudulent charges, items returned for credit, or fees of any kind, if applicable.) The $200.00 Welcome Bonus will be awarded in the form of 20,000 Reward points, which can be redeemed for $200.00 cashback. account. Offer valid for new qualifying Vantage West Signature® Rewards VISA® Credit Cards only and does not apply to increases, conversions, or re-opening of a closed credit card. Members with an existing Vantage West Signature® Rewards VISA® Credit Card are not eligible for the bonus.

2Merchants are assigned codes based on what they primarily sell. We group certain merchant codes into categories that are eligible for the Bonus Category Points. A purchase with a merchant will not earn Bonus Category Points if the merchant’s code is not included in our Dining, Entertainment and Groceries category.

Cash Back rewards are tracked as points and each $1 in Cash Back rewards is equal to 100 points. Points can be redeemed for cash back, merchandise, gift cards, travel, and charitable donations. Must have a minimum 2,500 points for cash redemption. Subject to change. Certain restrictions may apply. See Vantage West Rewards terms and conditions for details and restrictions of the program.

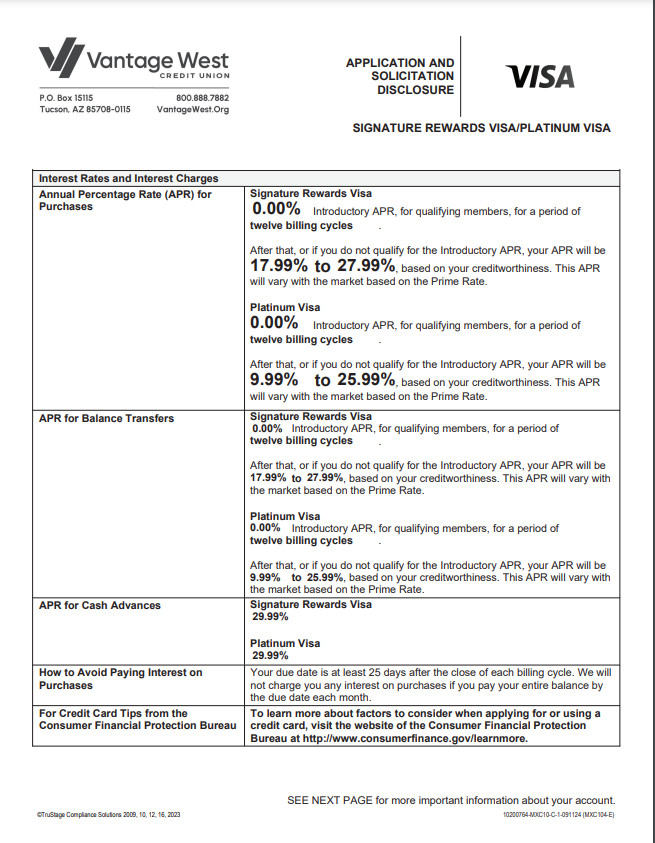

3Card type and APR are based on creditworthiness. Platinum Visa introductory rates are 0.00%, for twelve months, for qualifying members. Standard rates for the Platinum Visa after twelve month introductory period range from 9.99% APR to 25.99% APR. The Signature Rewards Visa has an introductory rate of 0.00%, for twelve months, for qualifying members. Standard rates for the Signature Rewards Visa after twelve month introductory period range from 17.99% APR to 27.99% APR. Rates are variable and are subject to change based on Prime Rate (rates based on Prime Rate as of 12/20/2024). Introductory rate offered only for new Signature Rewards and Platinum credit cards and does not apply to increases, conversions or re-opening of a closed credit card. Introductory APR offer subject to change without notice.

All loans are subject to credit approval. Membership required. Certain restrictions may apply.