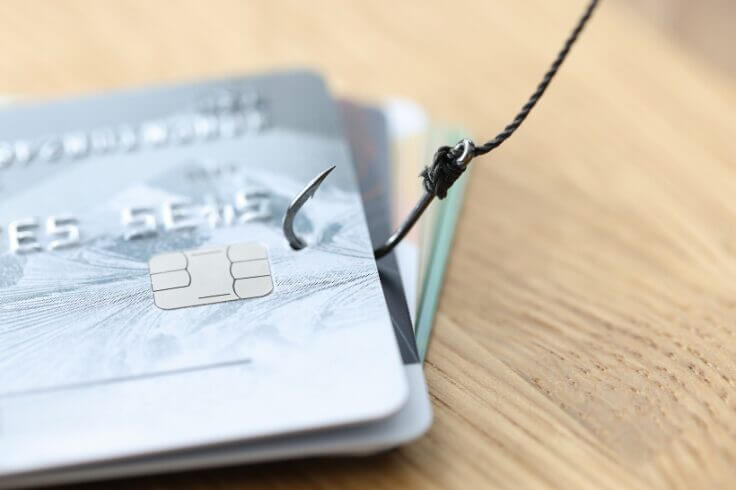

Card skimming and shimming are sophisticated methods used by criminals to steal credit card information and they pose significant risks to consumers.

Here’s how you can stay informed and safeguard your finances:

What is Card Skimming and Shimming?

- Card skimming involves criminals using devices called skimmers, discreetly attached to ATMs, gas pumps, or POS systems. These devices capture data from a card’s magnetic stripe as it is swiped or inserted.

- Card Shimming, on the other hand, targets chip-based cards using thin, card-like devices inserted into card slots to capture chip data.

How Skimming and Shimming Work:

When your card is skimmed or shimmed, thieves can obtain sensitive information like your name, card number, and card expiration date. This data is then sold on the black market or used to make unauthorized purchases or create counterfeit cards, placing the victim at serious financial risk.

Spotting and Preventing Skimming and Shimming

- Inspect the Card Reader: Before using any card reader, look for signs of tampering such as mismatched colors, loose parts, or unusual protrusions. A card reader that looks out of place could indicate the presence of a skimming device.

- Avoid Non-Bank ATMs: Non-bank ATMs, especially in less secure locations, are more vulnerable to tampering. Opt for bank-affiliated ATMs whenever possible.

- Use Secure Payment Options: NFC payments and chip-enabled terminals are safer alternatives to traditional swiping, as they reduce the risk of skimming attacks.

- Protect Your PIN: Shield the keypad when entering your PIN to prevent hidden cameras from capturing your information.

- Monitor Your Accounts: Regularly check your bank statements and set up alerts for unauthorized transactions. Early detection can minimize the impact of fraud.

What to Do If You Suspect Skimming or Shimming

- Avoid Using Suspicious Devices: If you suspect a skimming or shimming device, avoid using that machine and report it to the owner or authorities immediately.

- Monitor Your Bank Statements: Stay vigilant and report any unauthorized transactions to your bank promptly to prevent further fraud.

Vigilance is key to protecting yourself from card skimming and shimming. By being aware of potential threats and adopting secure payment practices, you can safeguard your financial information against these invasive theft techniques.

Want to learn more? Visit our Security Center for more resources to help safeguard your identity, accounts, and other sensitive information.