Who We Are And How We Lead

Leadership is both individual and a collective effort here on the vantage west team

President/CEO, Sandra Sagehorn-Elliott

Appointed in 2020 to lead the Vantage West team and carry a 70 year legacy forward, Sandra is responsible for leading, planning, directing, and managing all credit union activities within the framework of Vantage West’s vision and mission. She oversees organizational performance and ensures financial stability with the best interest of the members, employees, and credit union in mind.

Sandra is a credit union movement advocate with over 20 years of financial services experience, and a background in leading multifunctional teams, including consumer and commercial lending, information technology, retail branches, product development, marketing, call center, collections, digital banking, project management, operations, community relations, facilities, and investment services. She is a member of Filene Research Institute’s i3 credit union innovation program and a graduate of Harvard Business School’s Callahan Executive Education program. In 2022, Sandra completed the Cardwell Leadership Institute’s Advanced CEO Leadership Certification. Her guiding principle is, “Express gratitude and make sure people know you appreciate their contributions.”

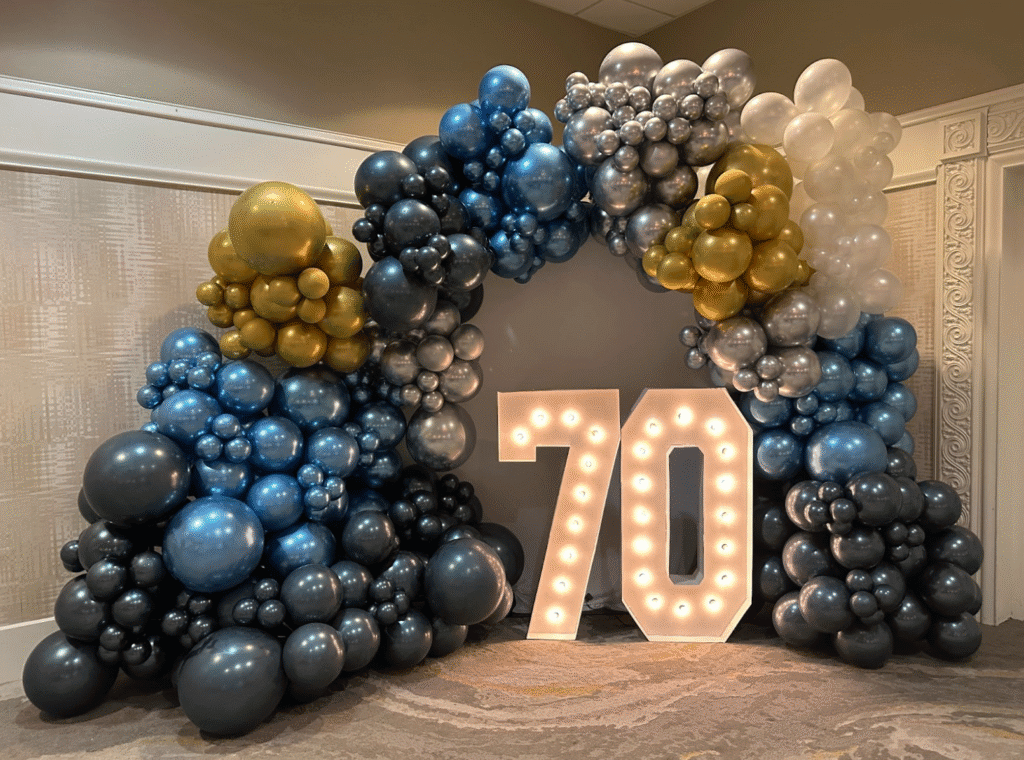

2026 Board Election & Annual Meeting

Update your email address or opt-in to emails from Vantage West by filling out this form.

"Our core values guide our daily interactions and decision-making, ensuring that we not only strive for personal and professional growth but also support each other in a respectful and empowering environment."

Proactive

Kind

Committed

What Our Team Has to Say

The best thing about coming to work are the people we get to collaborate with every day. With regular events for all team members to come together, it’s easy to feel a part of the community. When asked to describe our company culture, our team members wanted to share some of their impressions of their time at Vantage West.

Associates are encouraged to speak up and share ideas to help move the company forward. It is rewarding to see the positive impact resulting from such ideas.

It Takes a Professional Village

At Vantage West, our leadership team brings together many dedicated groups—spanning member service, business banking, community impact, financial wellness, and more—all united by one purpose: helping our member-owners and Arizona communities thrive. Every team is committed to meeting people where they are, offering the guidance, expertise, and local understanding that make banking feel more human, more accessible, and more supportive. Together, we work to create meaningful experiences and long-term value for the individuals, families, and businesses we serve.

Business relationship bankers

Branch Teams

Member Support

Operations & Leadership

Want to join Us?

If Vantage West sounds like a great place to work, that’s because it is. To learn more about working with us, jump over to our Careers page!

Disclosures

Vantage West is an Equal Opportunity Employer. Please contact Careers at (800) 888-7882 if you require reasonable accommodation to navigate this site and/or complete the online application process.