The Credit Card With the Right Credibility

Credit Union credit cards you've been searching for

Earn $200 cash back!

That’s right, simply open a Signature Credit Card today and once you use your card for $2000 in purchases within the first three months – Voila! Money in your pocket – well, loaded into your account that is!

A Credit Card that Suits You:

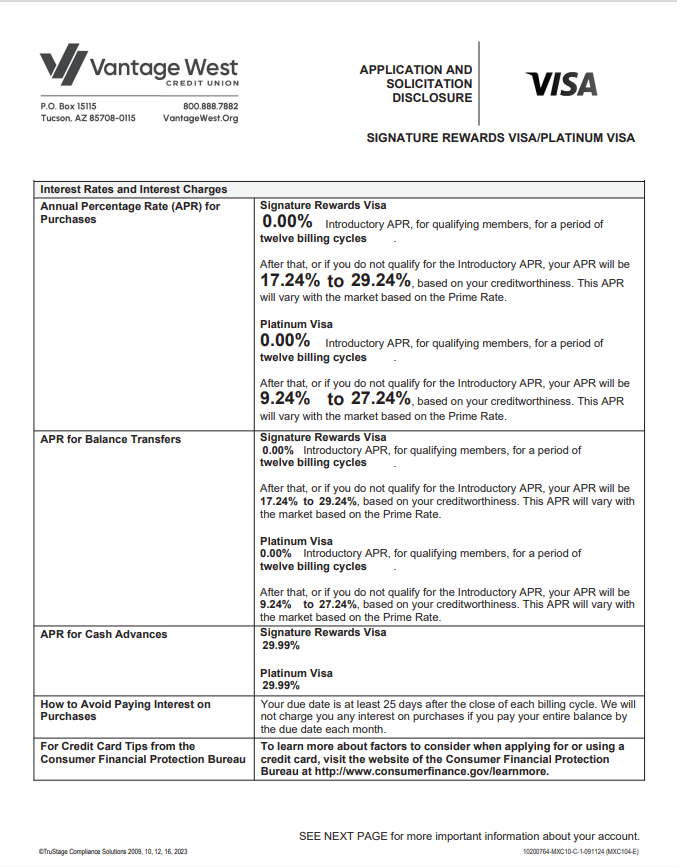

Platinum Visa®

Starting out with credit? This card is for you.

0% APR on purchases and balance transfers for the first 12 months³

After 12 months, as low as 9.24% APR – plus no annual fee!

No Application or Monthly Fees

Credit Lines starting at $1,000

Signature Rewards Visa®

Looking for a card with rewards? Start here!

No Application or Monthly or Annual Fees

0% APR for the first 12 months on purchases and balance transfers³

Are you interested in a loan product and would like to explore your options?

Did You Know?

Explore the benefits to opening a credit union credit card account with us

Quick Approval

No fee to apply.

Savvy Money

As you build your credit, we’ll notify you when you qualify for great rates on other loans.

No Annual Fees

Both cards offer great rates with no annual fee.

Take your card with you

Worldwide Access4: Withdraw cash from Visa® ATMs worldwide, anywhere you see a Visa® or PLUS logo.

Trusted by Arizonans

Looking for borrowing options that help you achieve bigger dreams or improving your credit score?

Accreditations & Recognitions

How Else Can We Help? Let’s Make It Easy.

What Are Members Saying?

Got questions For us?

Disclosures

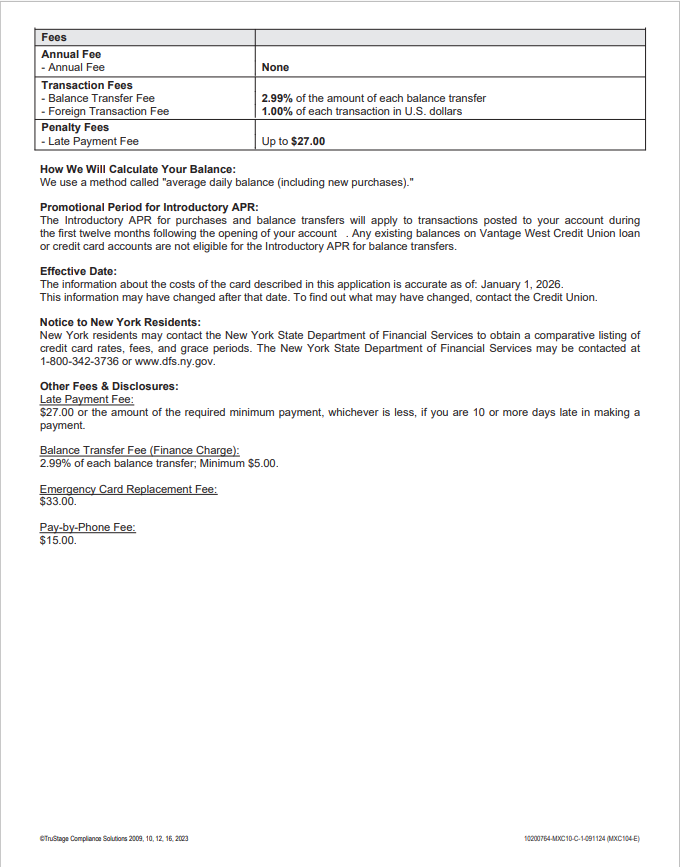

1To qualify and receive the $200.00 Welcome Bonus you must open a Vantage West Signature® Rewards VISA® Credit Card and make qualifying purchases, totaling $2,000 or more posted to your account, within the first 90 days of account opening. (“Purchases” do not include balance transfers, cash advances, interest, unauthorized or fraudulent charges, items returned for credit, or fees of any kind, if applicable.) The $200.00 Welcome Bonus will be awarded in the form of 20,000 Reward points, which can be redeemed for $200.00 cashback. Offer valid for new qualifying Vantage West Signature® Rewards VISA® Credit Cards only and does not apply to increases, conversions, or re-opening of a closed credit card. Members with an existing Vantage West Signature® Rewards VISA® Credit Card are not eligible for the bonus. Certain restrictions may apply.

Cash Back rewards are tracked as points and each $1 in Cash Back rewards is equal to 100 points. Points can be redeemed for cash back, merchandise, gift cards, travel, and charitable donations. Must have a minimum 2,500 points for cash redemption. Subject to change. Certain restrictions may apply. See Vantage West Rewards terms and conditions for details and restrictions of the program.

2Merchants are assigned codes based on what they primarily sell. We group certain merchant codes into categories that are eligible for the Bonus Category Points. A purchase with a merchant will not earn Bonus Category Points if the merchant’s code is not included in our Dining, Entertainment and Groceries category.

3Card type and APR are based on creditworthiness. Platinum Visa introductory rates are 0.00%, for twelve months, for qualifying members. Standard rates for the Platinum Visa after a twelve month introductory period range from 9.24% – 27.24%APR. The Signature Rewards Visa has an introductory rate of 0.00%, for twelve months, for qualifying members. Standard rates for the Signature Rewards Visa after a twelve month introductory period range from 17.24% – 29.24% APR. Introductory rate offered only for new Signature Rewards and Platinum credit cards and does not apply to increases, conversions, or re-opening of a closed credit card. Rates are variable and are subject to change. Rates are based on Prime Rate and are accurate as of 01/05/2026. All loans are subject to credit approval. Membership required. Certain restrictions may apply.

4Visa card holders with international transactions (such as US-dollar online purchases from a foreign country, or transactions enacted in a foreign country) will be charged, by Visa, an International Service Assessment (ISA), which is currently 1% for multicurrency transactions and for single currency transactions.